Table of Content

The title should also reveal whether the house has certain appliances, such as a garbage disposal or dishwasher. There’s no better way to feel like Sherlock Holmes sleuthing for evidence than by digging into the history of a property. Whatever your reason, you want to know more about the property’s history beyond the scant details provided. You need more information before you make such a huge investment. Amber was one of HomeLight’s Buyer Center editors and has been a real estate content expert since 2014.

Drought risk is based on water stress, which estimates how much of the future water supply will be used for human purposes, like watering the lawn. The latest migration analysis is based on a sample of about two million Redfin.com users who searched for homes across more than 100 metro areas. To be included in this dataset, a Redfin.com user must have viewed at least 10 homes in a three month period.

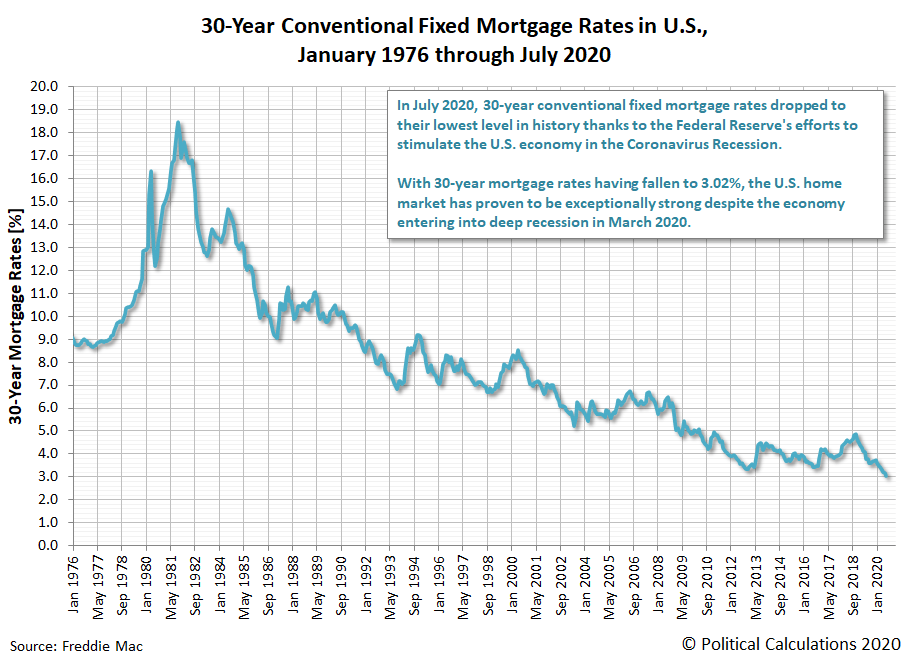

Conservatorship of Fannie Mae

Although home prices rose, lower rates and higher household incomes made the median home affordable to the median earning household. And though effects were distributed , generally median home prices tracked what the median household could afford in monthly payments. You can look up the sale history of a house by checking the public records available at the county recorder of deeds or the tax assessor's office. The weights used in constructing the indexes are estimates for the shares of one-unit detached properties in each state. For years in which decennial census data are available, the share from the relevant census is used. For intervening years, a state’s share is the weighted average of the relevant shares in the prior and subsequent censuses, where the weights are changed by ten percentage points each year.

They can also indicate whether homes are lingering on the market or being sold faster than sellers are listing them. There are currently 1,559,575 residential homes for sale in the United States. That confluence of factors happened during the 2011-late 2020 US housing market.

Annual Report to Congress

The good news is that most conventional loan programs only require a 3% down payment and FHA loans have a minimum down payment of 3.5%. The general rule of thumb is that the larger your down payment the more loan options you will have and typically lowers your monthly payments and lowers your interest rate. Your credit score, and the credit score of any co-borrower, will be a critical factor in determining the loan programs and interest rates you qualify for. One other consideration in determining the amount of savings you need to have to buy your home is the closing costs - a variety of fees required to create your loan.

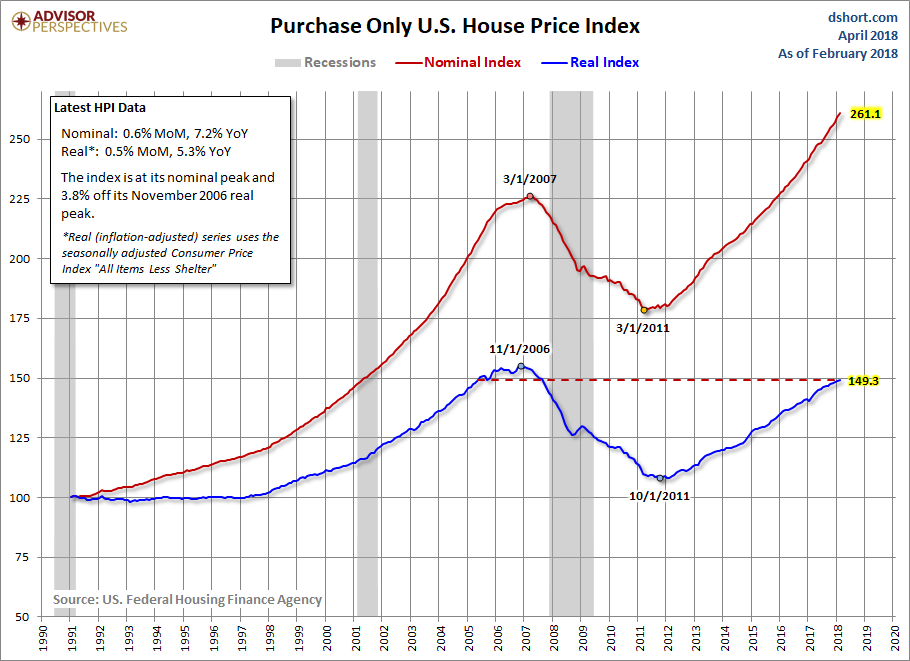

That is, the HPI equals 100 for all MSAs in the first quarter of 1995. States and divisions are normalized to 100 in the first quarter of 1980. The purchase-only indexes are normalized to 100 in the first quarter of 1991.

Mortgages & Remodeling

With this service, you can discover more about the current or previous property owners, as well as the sales history and home value of the house. Price plans for BeenVerified range from $17.48 per month to $26.89 per month. MLS listings will have details about the house, such as the materials used for the roof and siding, how many parking spaces are in the garage, and other variables that are good to know about a listing. It’ll show you both the sales history of the house and the different prices it has sold for.

Beginning in March 2008, OFHEO (one of FHFA’s predecessor agencies) began publishing monthly indexes for census divisions and the U.S. FHFA does not publish a repeat purchase index for the eleven metropolitan areas comprised of metropolitan divisions. Therefore, Moody's Analytics estimates a repeat purchase index for these areas . This series is created from a weighted average of the metropolitan division repeat purchase indices. Moody's Analytics estimates of home sales by metropolitan division are used as the weights. Use prices from sales transactions of mortgage data obtained from the Enterprises.

Purchasing a House

Real estate listings held by brokerage firms other than Zillow, Inc are marked with the IDX logo or the IDX thumbnail logo and detailed information about them includes the name of the listing brokers. Copyright 2022 the Greater El Paso Association of REALTORS®, MLS Inc. Any offer of compensation is made only to Participants of the PPMLS. This information and related content is deemed reliable but is not guaranteed accurate by the Pikes Peak REALTOR® Services Corp. The “four-quarter” percentage change in home values is simply the price change relative to the same quarter one year earlier.

Companies like Get Title Shield offer free online title searches as part of their offering of selling title insurance. Listing information is provided by Participants of the Great Plains Regional Multiple Listing Service Inc. Copyright 2022, Great Plains Regional Multiple Listing Service, Inc.

FHFA has access to this information by virtue of its role as the federal regulator responsible for these government-sponsored enterprises. Due to a 30- to 45-day lag time from loan origination to Enterprise funding, FHFA receives data on new fundings for one additional month following the last month of the quarter. Once you’ve found that ideal home, you need to work with your real estate agent to make an offer. This offer will be presented in the form of a formal letter and include details on yourself, the price you’re willing to pay, and a deadline for the seller to respond to your offer. It’s possible to buy a home without a real estate agent, but it’s not recommended. These experts will help you to navigate a relatively complex real estate market, submit legally viable offers, and avoid overpaying for a home.

Next, we want to make sure that you’re not already supporting too much debt. To evaluate that we’re going to calculate a debt-to-income ratio. This is a quick way to determine how much of your income is already going to other debt payments and how much mortgage debt you can realistically take on. You can export the three affordability series using the hamburger menu in the upper right corner of the upper graph. Choose to export to PNG or SVG for the graphic, or export to CSV to work on the numbers elsewhere. And don';t forget to overlay homeownership rates – that tool also allows you to export the series over time.

This site is not authorized by the New York State Department of Financial Services. No mortgage applications for properties located in the state of New York will be accepted through this site. Although such an option might exist from time-to-time, most homeowners need to have some cash for a down payment. For $12, the site will compile a report that tells you whether a death has occurred in your home and when it happened. Beyond that, it will also tell you if there have been any fire incidents or meth activity in the house. But the website DiedInHouse.com will tell you whether anyone has died in your home.

On average, homes in Dallas sell after 32 days on the market compared to 28 days last year. There were 684 homes sold in November this year, down from 1,087 last year. You can confirm the property you’re interested in doesn’t have any current or previous issues by searching hundreds of thousands of local, state, and federal documents that have been organized into this database. If you have the names of previous owners, you could look them up in the database and get additional insight on the house you’re considering. For example, if the house was previously owned by someone who worked as a farmer, you’ll know the other houses nearby are likely newer as the surrounding land would have been farmland at the time. Another option is using a service like Been Verified that can conduct a reverse address lookup.

Homebuyers Are Looking to Relocate to Affordable Areas–Especially in Florida–Amid High Rates, Prices

Smart buyers will also check news stories related to the house by clicking on the “news” subsection at the top of your Google search results. If you’re curious about how to find the history of a property online, you’re in luck. From interviewing professional experts to researching sources, we’ve gathered all the different ways you can find the history of a property online. Check for the past transaction price of the home on websites such as Zillow.com, Trulia.com and Realtor.com. Some websites charge a fee for this service but most offer free information.

No comments:

Post a Comment