Table of Content

That's why we offer features like your Approval Odds and savings estimates. Not only has Global Database become the go-to B2B intelligence platform, but they are establishing its place as a unique directory that will cover all firm intel needs and requirements. On prime of that, the API they offer offers you with integration potentialities together with your system or software program to achieve automated lead scoring and/or onboarding processes. The solely distinction between a lock and a freeze is how they're positioned and lifted. Credit locks are marketed basically as being user-friendly credit score freezes.

Loans Explore the nuances of the different sorts of loans, together with personal and scholar loans, and the potential pros and cons of co-signing a mortgage. Our Sales Specialists will present strategic guidance and match you to the best merchandise and options. Print out your full updated report, circle the inaccurate data and write within the purpose you are disputing that merchandise. Online Credit Appto streamline the information collection and report pulling processes.

What’s The Small Business Financial Exchange?

Instead of contacting the bureaus to have them freeze or thaw your report, you are capable of do it yourself through the bureau's site or cellular app. Another good tip, if you’re looking for one of the best mortgage choices, is to concentrate on your FICO rating. A 2018 report discovered that there’s been an increase of greater than 20% in VantageScore utilization, however this rise doesn’t apply to the mortgage market. It’s doubtless you’ll only discover out which score they used if you’re denied an offer you applied for and are despatched the rejection discover required by law. There’s no particular way of knowing which credit score rating your lender or creditor will really use--most will look at the versions they think about best fits their needs. There’s also the FICO Score 3 which is used primarily for bank card lending.

Confirm in case your buyer or provider has any CCJs, late or missed funds. Verify the identity of company directors and carry out additional consumer checks. Auto, homeowners, and renters insurance coverage companies provided by way of Karma Insurance Services, LLC (CA resident license # ). Of course, the offers on our platform do not characterize all financial products out there, but our aim is to indicate you as many great choices as we can. Compensation might issue into how and the place merchandise appear on our platform . But since we usually generate income if you discover an offer you like and get, we attempt to show you offers we predict are a great match for you.

Dun & Bradstreet Credit Score Scores

Check with Dun & Bradstreet to see if your small business is already registered for a DUNS quantity.

Credit Cards Explore tips on getting the best bank card for you and what it means in your credit. Plus, managing credit card debt and what to do when you misplaced your card. Get higher prepared to watch your credit and assist higher shield your id with Equifax Complete™.

Significance Of Constructing Credit For You

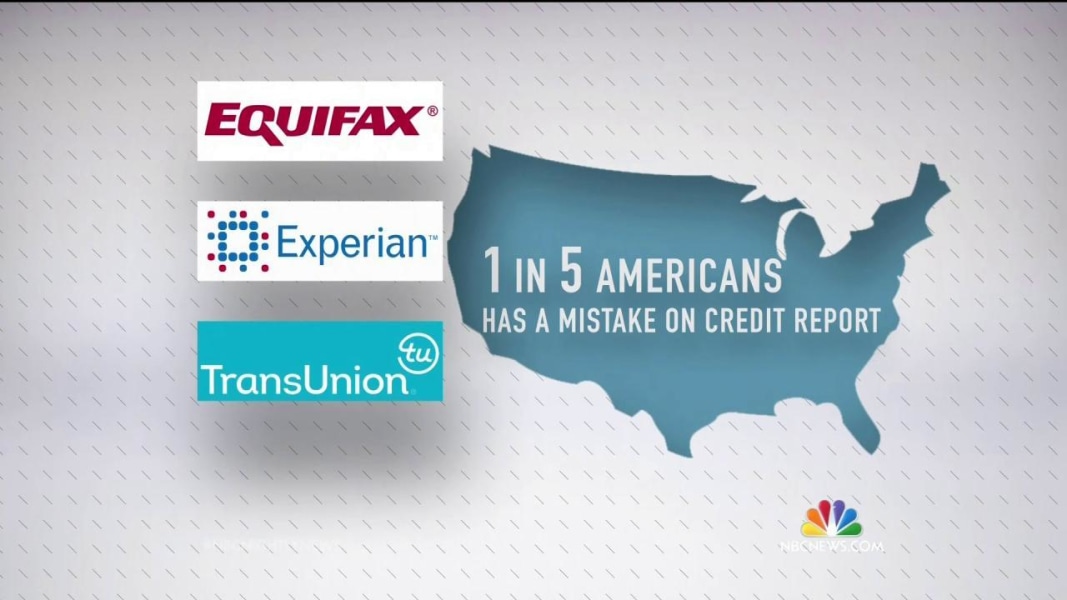

Most enterprise reports incorporate a financial evaluation that sums up a business’ potential and profitability. These also highlight the critical factors, if any, aiding you in making information-driven decisions. Besides providing recommended credit score limits, credit score report providers show a global danger rating. Thanks to the Fair and Accurate Credit Transactions Act passed by Congress in 2003, everyone is entitled to a free yearly credit report from all three credit bureaus. These free yearly credit score reports could be obtained through AnnualCreditReport.com; however, along with offering these free reports, the three major bureaus additionally supply their very own credit reporting companies. 5) Dun & Bradstreet – Dun & Bradstreet is amongst the major enterprise credit score reporting agencies you most likely have heard about.

The FICO Auto Score aims to offer a more comprehensive rating for auto-financing, as an example, and the FICO Bankcard Score is for bank card functions. The firm says their most widely used model is the FICO Score eight despite the precise fact that Score 9 is already obtainable. These two variations analyze your credit report info from the three major bureaus, and provide you with a single rating.

Business Highlights

Building credit score in your SMB (small or medium-sized business) is important. Companies that construct good credit score will be approved for interest-free commerce credit from new distributors by way of invoicing on account with fee terms. The D&B PAYDEX Score measures a company’s history of payment performance. The Dun & Bradstreet PAYDEX rating ranges from 1 to 100 with three risk categories by vary. A PAYDEX rating of eighty – a hundred signifies a low risk of late fee; 50 – 79 is average risk, and 1 – forty nine is excessive risk.

Help look after your family with credit monitoring and ID theft safety options. Small enterprise owners who perceive their enterprise credit score are 41% extra more doubtless to be permitted for a enterprise loan, according to Nav’s American Dream Gap Survey. 12) National Association of Credit Management – NACM is the go-to supply for greater than 15,000 businesses nationwide for credit score info. The National Trade Credit Report supplies users with tradelines derived from lots of of NACM members across 1,000 industry credit score groups.

These embody the Business Failure Score, Payment Index, Payment Trend, Equifax Delinquency Score for Other, Small Business Financial Risk Score for Financial Services . Businesses can apply for either 30-day or 60-day terms on the Commercial Account card. The Commercial Account card provides a 2% early pay discount for on-line invoice fee in 20 days.

The tools these firms offer are specially designed to identify fraudulent exercise and doubtlessly forestall damage to your credit score. They do this by monitoring social safety numbers, public data, and the dark net. Most small enterprise credit cards report to at least one of the main credit reporting agencies. This chart lists how particular small business bank cards could help construct business credit.

Additionally, attempting to open a new credit account results in onerous inquiries. A onerous inquiry, or onerous pull, occurs when a creditor takes a detailed look into your credit report to decide if they wish to give you a new line of credit or not. Too many onerous inquiries on your credit report over a brief time period could make collectors suppose that you’re desperate to open new credit accounts as a end result of you’re having cash hassle. After that, late funds will be marked as ninety, 120, or 150 days late. A charge-off happens when so much time has passed by that collectors assume you won’t ever pay them back.

(See the Summa Office Supplies info.) The Business Application and checkout process for a internet 30 account are similar to Summa Office Supplies. Summa Office Supplies has a net 30 utility on-line and includes an FAQ web page about its internet 30 accounts on the website. The first step of the Business Application is to register on the website.

No comments:

Post a Comment